Tax Configuration

Tax configuration determines how Brother POS calculates and displays tax on every sale. Correct tax setup is critical for compliance and accurate reporting.

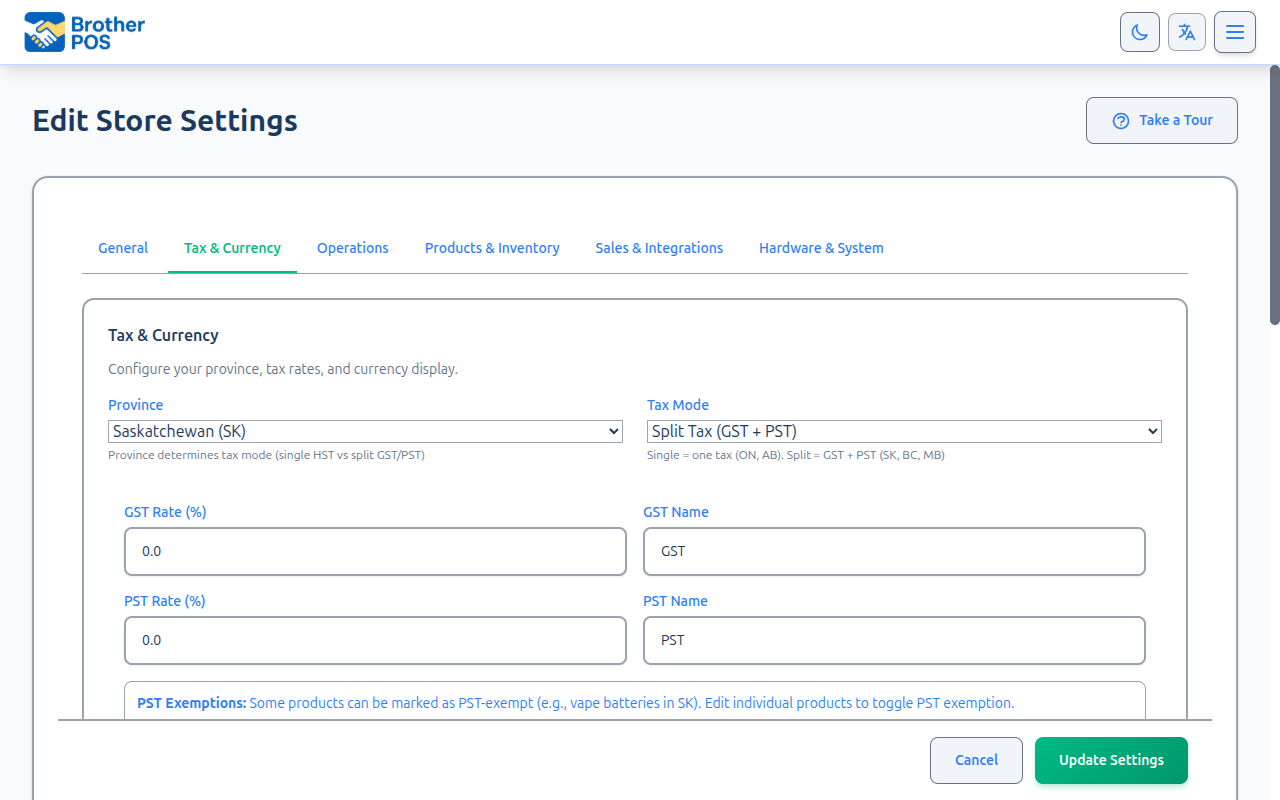

Accessing Tax Settings

- Log in to the Admin Panel.

- Click Settings in the top navigation bar.

- Click Edit Settings.

- Click the Tax & Currency tab.

Standard Tax Rate

Most Canadian provinces use a single combined tax rate. This is the simplest configuration.

Setting a Single Tax Rate

- Enter the Tax Rate as a percentage (e.g.,

13for 13% HST in Ontario). - Enter the Tax Label (e.g., "HST").

- Click Save.

Common single-rate provinces:

| Province | Rate | Label |

|---|---|---|

| Ontario | 13% | HST |

| New Brunswick | 15% | HST |

| Nova Scotia | 15% | HST |

| Newfoundland | 15% | HST |

| PEI | 15% | HST |

All product prices in Brother POS are entered pre-tax. Tax is calculated and added at the time of sale. Customers see the tax as a separate line item on their receipt.

Split Tax Mode (GST/PST)

Some provinces charge GST and PST as separate taxes rather than a single harmonized rate. Brother POS supports this with split tax mode.

Enabling Split Tax

- Select Split Tax (GST/PST) from the Tax Mode dropdown.

- Enter the GST Rate (e.g.,

5for 5% GST). - Enter the GST Label (e.g., "GST").

- Enter the PST Rate (e.g.,

6for 6% PST in Saskatchewan). - Enter the PST Label (e.g., "PST").

- Click Save.

Provinces that require split tax:

| Province | GST | PST | Total |

|---|---|---|---|

| British Columbia | 5% | 7% | 12% |

| Saskatchewan | 5% | 6% | 11% |

| Manitoba | 5% | 7% | 12% |

| Quebec | 5% (GST) | 9.975% (QST) | 14.975% |

How Split Tax Appears

When split tax mode is enabled:

- The POS register shows each tax component separately in the cart totals.

- Receipts print each tax on its own line (e.g., "GST: $2.50" and "PST: $3.00").

- Reports break down tax collected by component.

- Compliance exports separate GST and PST amounts.

Quebec's QST is calculated on the pre-tax amount (not on the GST-inclusive amount, as was the case historically). Enter 9.975 as the PST rate if you are in Quebec. Brother POS applies both taxes to the pre-tax subtotal independently.

Additional Tax

Some product categories are subject to an additional surcharge tax beyond the standard rate. Brother POS supports one additional tax layer for this purpose.

Common Use Case: Vapour Products Tax

Saskatchewan charges an additional Vapour Products Tax on vaping products. Similar surcharges exist in other jurisdictions.

Setting Up Additional Tax

- Check the Enable Additional Tax checkbox.

- Enter the Additional Tax Rate (e.g.,

20for a 20% surcharge). - Enter the Additional Tax Label (e.g., "Vapour Products Tax").

- Click Save.

Set the additional tax name and rate. Additional tax can be configured per-category or per-product on their respective edit pages.

How Additional Tax Appears

- The additional tax is shown as a separate line item in the POS cart.

- Receipts print it as its own line (e.g., "Vapour Products Tax: $4.00").

- Reports include the additional tax in a separate column.

- The additional tax is calculated on the pre-tax product price, not on top of other taxes.

Tax Calculation Details

Calculation Order

Brother POS calculates taxes in this order:

- Subtotal -- Sum of all product prices (pre-tax, after discounts).

- Standard Tax -- The single rate or GST/PST split applied to the subtotal.

- Additional Tax -- Applied only to eligible products, calculated on their pre-tax price.

- Total -- Subtotal + Standard Tax + Additional Tax.

Rounding

Tax is calculated per line item and rounded to 2 decimal places. The total tax shown is the sum of all rounded line-item taxes, which may occasionally differ by a penny from calculating tax on the total subtotal.

Discounts and Tax

Discounts reduce the taxable amount. If a $20 product has a $5 discount, tax is calculated on $15 (the discounted price), not on $20.

Verifying Your Tax Setup

After configuring taxes, verify the setup:

- Go to the POS Register.

- Add a product to the cart.

- Check that the tax line(s) show the correct amount(s).

- If using split tax, verify both GST and PST appear separately.

- If using additional tax, add a product from an eligible category and verify the surcharge appears.

For easy verification, add a product priced at $100. With 13% HST, you should see exactly $13.00 in tax for a total of $113.00.

Changing Tax Rates

Tax rates change occasionally (e.g., when a province adjusts its PST rate).

- Update the rate in Settings > Edit Settings > Tax & Currency tab.

- Click Save.

- The new rate takes effect immediately for all future sales.

Changing the tax rate does not affect historical sales. Past transactions retain the tax rate that was in effect at the time of the sale. This is correct behavior -- tax changes should only apply going forward.

Common Questions

Do I need to set tax rates for online orders? WooCommerce manages its own tax settings. Brother POS tax settings only apply to in-store POS transactions and Brother POS-generated reports.

Can different products have different base tax rates? No. All products share the same base tax rate (or GST/PST rates). The additional tax feature handles surcharges on specific categories. If your jurisdiction requires product-level tax variation beyond this, contact support.

What if my province has no PST?

Use the single tax rate mode. Alberta, for example, would use 5 as the tax rate with "GST" as the label.

What's Next?

- General Settings -- Configure your store name, address, and timezone.

- Operations -- Set up receipt preferences and order numbering.

- Feature Flags -- Enable or disable optional store features.