Returns

The Returns workflow in Brother POS lets you formally process returned items against an original sale. Unlike voiding (which cancels a sale entirely), a return handles specific items, calculates refund amounts, optionally restocks inventory, and can issue store credit when the original payment method is not available.

Before You Begin

- You must have the process_returns permission. This is typically granted to managers and admins.

- You need the original sale receipt number to locate the sale being returned against.

- Returns can be processed at any time -- same day or weeks later.

Use a void when you need to cancel a sale immediately (wrong item, price error). Use a return when a customer brings items back after the fact. See Voiding Sales for the void workflow.

Processing a Return

Step-by-Step

-

Open the Returns interface. In the admin panel, go to the Returns section in the admin panel and click Process Return. Returns are managed from the admin panel, not directly from the POS register.

-

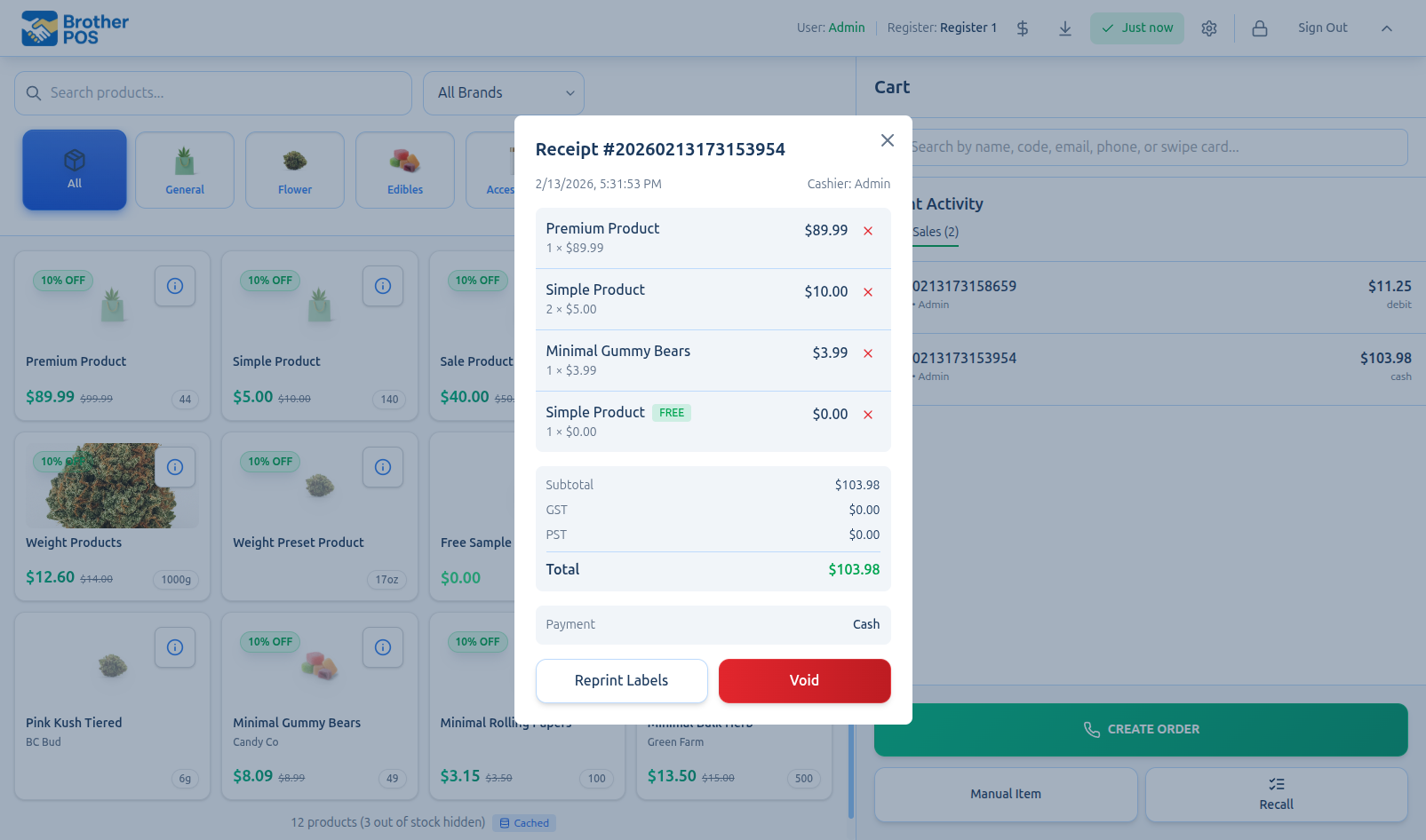

Locate the original sale. Enter the receipt number from the customer's receipt. The system pulls up the sale details including all line items, the customer, and the payment method.

-

Select items to return. For each item the customer is returning:

- Check the item to include it in the return.

- Adjust the quantity if the customer is only returning part of what they purchased (e.g., returning 2 of the 3 they bought).

- Optionally enter a return reason for each item (e.g., "Defective", "Wrong strain", "Customer changed mind").

- Optionally add return notes with additional context.

-

Choose a refund method:

Refund Method When to Use Cash Customer paid cash and wants cash back. Requires an open cash drawer session. Debit Customer paid by card. The return is recorded in Brother POS; process the actual card refund on the terminal separately. Store credit Issue a store credit code the customer can use on future purchases. Exchange Customer exchanges the returned items for different products. -

Choose whether to restock. By default, returned items are added back to inventory. Uncheck the restock option if the items are damaged or unsellable.

-

Enter a reason for the overall return (e.g., "Customer dissatisfied", "Product defect").

-

Review and confirm. Verify the return summary:

- Items being returned and quantities

- Subtotal and tax amounts

- Total refund amount

- Refund method

- Restock setting

-

Tap Process Return to finalize.

Return Details

What Gets Calculated

Brother POS calculates the return amounts based on the original sale prices:

| Field | Calculation |

|---|---|

| Unit price | Pulled from the original sale line item (not the current product price) |

| Line total | Unit price multiplied by the return quantity |

| Subtotal | Sum of all return line totals |

| Tax amount | Calculated at the same rate as the original sale |

| Refund amount | Subtotal plus tax |

Returns always use the price from the original sale, even if the product price has changed since then. This ensures the customer receives an accurate refund.

Return Number

Each return receives a unique return number for tracking purposes. This number appears on the return receipt and can be referenced in reports.

Store Credit

When you choose store credit as the refund method, the system automatically generates a store credit:

| Field | Description |

|---|---|

| Credit code | A unique alphanumeric code the customer uses to redeem |

| Original amount | The full refund amount |

| Balance | Starts at the original amount, decreases as the customer uses it |

| Status | Active, partially used, or fully redeemed |

| Expiration | Set by your store's policy (if configured) |

How Customers Use Store Credit

- On a future visit, the cashier attaches the customer to the sale.

- At payment, the cashier selects the store credit payment option.

- The credit code is entered or scanned.

- The balance is applied to the sale. If the credit does not cover the full amount, the remaining balance is paid with another method.

Store credit codes should be given to the customer on their return receipt. If they lose the code, a manager can look it up in the admin panel under the customer's profile.

Partial Returns

You do not have to return every item from a sale. Brother POS supports partial returns:

- Partial item selection -- Return only some items from a multi-item sale.

- Partial quantity -- Return fewer units than were originally purchased (e.g., customer bought 5 pre-rolls, returning 2).

The refund amount is calculated only for the items and quantities being returned.

Restocking

By default, the Restock Items option is enabled. When restocking is active:

- Returned items have their stock counts incremented in the inventory system.

- The restocked status is recorded on each return line item for auditing.

Disable restocking when:

- The product is damaged or defective and cannot be resold.

- The product is expired or past its sell-by date.

- The return is for a consumed item (e.g., an opened cannabis product that cannot be resold per regulations).

In regulated cannabis markets, returned products may not be eligible for restocking due to chain-of-custody requirements. Follow your jurisdiction's regulations when deciding whether to restock cannabis items.

Permissions

| Action | Cashier | Manager |

|---|---|---|

| Process a return | No | Yes |

| View return history | No | Yes |

| Issue store credit | No | Yes |

Cashiers who need to process a return must call a manager to handle the transaction.

Common Scenarios

Customer Returns With Receipt

The straightforward case. Look up the sale by receipt number, select the items to return, choose the refund method, and process.

Customer Returns Without Receipt

If the customer does not have a receipt but is in your system:

- Look up the customer in the admin panel.

- Find the original sale in their purchase history.

- Note the receipt number and process the return from the POS.

If the customer is not in your system and has no receipt, your store policy determines whether you can process the return. Some stores issue store credit only (no cash refund) for receiptless returns.

Returning an Item From a Split Payment Sale

The refund amount is based on the item price, not the payment method split. Choose the most appropriate single refund method (cash, debit, store credit, or exchange) for the return.

Customer Wants Exchange Instead of Refund

Exchange is available as a refund method option when processing a return through the admin panel. Select Exchange from the refund method dropdown when the customer wants to swap the returned items for different products.

Viewing Return History

Managers can view past returns in the admin panel:

- Open the Returns section in the admin panel.

- Returns are listed with the return number, original sale reference, customer, refund amount, and status.

- Click a return to see the full details including individual line items and restocking status.

Troubleshooting

| Problem | Solution |

|---|---|

| Cannot find the original sale | Make sure you are entering the correct receipt number. If the sale is from a previous day, it may not appear in POS Sales History -- use the admin panel. |

| "Failed to create return" error | Check that the items you selected are valid. An item that was already fully returned cannot be returned again. |

| Store credit not generated | Verify you selected "Store credit" as the refund method before processing. |

| Inventory not restocked | Check if the "Restock Items" option was enabled. If it was unchecked, items are not added back to stock. |

| Return permission denied | Only users with the Process Returns permission can process returns. Contact your admin. |

Best Practices

- Always verify the original receipt. Confirm the items and quantities match what the customer is actually returning.

- Inspect returned items before restocking. Ensure products are in resellable condition, especially for cannabis items with regulatory requirements.

- Document reasons clearly. Detailed return reasons help identify product quality issues and inform purchasing decisions.

- Offer store credit for receiptless returns. This protects the store while still accommodating the customer.

- Review return reports regularly. Frequent returns on the same product may indicate a quality issue that needs attention.

What's Next?

- Voiding Sales -- Cancel a sale immediately after processing

- Sales History -- View and manage completed sales

- WooCommerce Orders -- Handle returns for online orders